Many people might call me a loser. Even though I don't have many negative attributes, I just haven't been able to really get what I want out of life. This blog is a means of helping me figure out what things went wrong and how they went wrong, but will not offer any solutions on how I can fix my problems. There will be no epiphanies here. I am trying to take a light-hearted look at my life, despite the many dark areas.

Wednesday, May 3, 2017

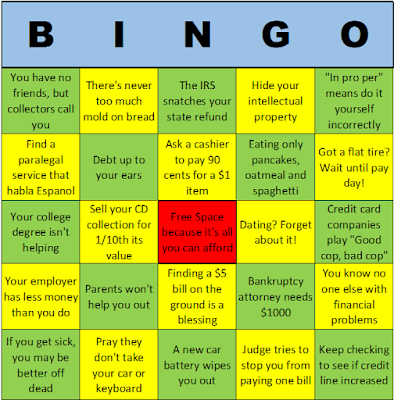

Bankruptcy Bingo

In yesterday's post, I explained what set me on my path to being bankrupt. Today, I'll focus on the process I had to go through to rupt my bank.

I was surprisingly proactive in finding out what I had to do to declare bankruptcy. Even though the plan was to wait until after I had a default judgement against me, I decided to do so research to see what I needed to do. I had always heard that I needed to have an attorney represent me. Somehow, I was referred to this one person. I got in contact with him over the phone. I asked him what his fee was. He said it was $1000. I asked him if he had financing plans. He said he didn't. He expected the full amount upfront because he'd had clients who would name him as one of the debtors in their bankruptcy filings.

However, he did give the best free advice an attorney could offer. First, he instructed me to go ahead and file bankruptcy before the court date for the lawsuit. If I did that, it might put a stop to the judgement against me and it wouldn't be on my record. He also said that since I really only owed two entities money (the insurance company and the credit card), I really didn't need representation. I could file myself and pay a paralegal service to prepare the paperwork for me. I could probably find one that would do it for a few hundred dollars. I thanked him for the advice.

So now, I had to find a paralegal service. I looked up several in the phone book and visited a few to get quotations. Most of them charged around $500 to $600. I did learn the correct term for self-filing: "In pro per." It looks like "improper," like they know you're going to do it wrong. I did find one service that would do it for $200 plus the $60 filing fee. That was a bargain.

I gave them all the information on my debtors. They told me I couldn't get out of paying the IRS, which I knew. In addition to the insurance company, they included the person who was injured in the accident in the filing. I didn't like that. I didn't want him knowing that I was avoiding having to pay for my part in his suffering and being reminded of the incident, but I couldn't put a stop to that.

One thing I was surprised I was able to do without an attorney was stop the harassing phone calls from the credit card company. I got called at least once a month demanding to know when I was going to make the next payment. When I knew I was going through with the filing, I replied, "Probably not, because I'm declaring bankruptcy." I had been shouted out by the collectors before, so I was expecting even more this time, but the collector was actually very pleasant about it. He really didn't have anything more to say and I never heard from them again. If I'd known I could have stopped those collection calls just by saying "bankruptcy" and not filing until it was absolutely necessary, I could have saved myself a lot of grief and a lot of money.

Even though I took action early on to file for bankruptcy, I fell back into my old procrastination habits when it came to doing what I needed to do to keep the process moving. I needed to deliver the forms to the court on a specific date. On that Friday, I called to find out if I could mail it in and if the postmark would count. They said no, I needed to come there that day to deliver everything. I just knew that a whole bunch of other people were going to be lined up because they also procrastinated and I was going to have to wait all afternoon. I drove to the court in Downtown San Diego. When I went inside, I was surprised to see that there was no line. I just went up to the window and presented the filing. That was it.

The next thing I had to wait for was a hearing date. I received the notice in the mail. This notice appeared to state that at least one of my debtors was going to appear at the hearing to contest my filing. I discussed this with Knod's mother, who had been through bankruptcy before. She told me that there was likely not going to be anyone who would show up to do that, because no one had showed up at her hearing. I really didn't know what to expect.

There were a few of us who had to appear in bankruptcy court that afternoon. I looked around, but couldn't tell if any of my debtors was there. I didn't see anyone trying to stare me down. There were a few other cases before me. Most of them just appeared before the judge, answered a few questions about their finances and left. There was only one person who had someone come up to confront him about his filing. They asked about the location of tools that he had financed from them. He said he didn't have them anymore. There wasn't a lot that could be done about that.

When it was my turn, there was no one to challenge my filing. I was worried about nothing. But I had to let the court know that I was going to be reaffirming one of my debts. That would be the loan with the credit union (that covered the fines and lawyer fees associated with the accident). I decided to keep making payments on the loan because I knew that if I ever needed money in a pinch, they would still be able to loan it to me (although it would be at a higher interest rate). This turned out to be the smartest decision I made in the process. The judge told me I needed to appear in court again to reaffirm that debt before bankruptcy would be declared.

When that court date came, I appeared before the judge to verify that I wanted to reaffirm my debt with the credit union. The judge said, "You know, you DON'T have to do this." "I know, but I want to." "Okay, but you DON'T have to do this." (Did the judge seriously think that continuing to pay a debt I owed was a really bad idea?) At any rate, the judge approved it and that was it for me.

During this entire endeavor, I anticipated that I would have to make a final appearance in court and that a judge would officially declare, "YOU ARE NOW BANKRUPT! YOUR LIFE AS YOU KNOW IT IS OVER!" But that didn't happen. I simply got a notice in the mail saying that the bankruptcy process was completed and I was clear of the debts I had claimed. I reflected on this for awhile. I never expected that I would be bankrupt before I turned 30. I felt like a loser all over again.

Mr. T had received a notice from the court that there was a default judgement against me declared. He provided an exact amount. I don't remember what it was, but it was more than was was on the subpoena I had been served. It didn't really matter at that point. I was absolved of paying that insurance company anything. (Oddly enough, I would wind up using that insurance company later on when I had to get auto insurance, so they did get something out of me.)

But in the end, being bankrupt really didn't have that much impact on my life, at least, not as much as I anticipated. There were a couple of apartments I didn't get approved for, but most places would still rent to me because the record showed I always paid my rent on time, so I was always able to find a place to live. When I needed a loan in 1995, I was able to get one from the credit union. In 1999, I was able to finance a new car from them, so I was glad that I reaffirmed that debt.

One thing I actually liked about bankruptcy was when credit card companies were signing up customers, like at the airport, with free gifts. I would apply, knowing I would be declined, but I would still get the gift. I knew that the bankruptcy's impact on my life was coming to a close in 2001 when I applied for a credit card and was actually approved.

The funny thing is that I am currently in more debt now than I was then, including the judgement against me.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment